Insurance and Loan Business Automation That Works Smarter

Fixxable’s insurance and loan business automation platform helps UK insurance brokers and loan advisers streamline renewals and client management. It’s the smarter insurance automation software UK teams use to cut admin and improve efficiency.

Proven Results for Insurance Brokers & Loan Advisers

See how Fixxable automation helps UK finance teams streamline admin, improve client retention, and deliver faster, compliant service with insurance and loan business automation designed for UK professionals.

Faster Client Response Times

Automated emails and SMS alerts ensure every enquiry and renewal request is answered quickly — no lost leads or delayed replies.

Hours Saved on Admin Each Week

With financial services automation, policy renewals, loan updates, and client reminders run automatically, giving your team more time for clients.

Improved Client Retention

Smart follow-ups and renewal notifications keep clients engaged — reducing missed payments and boosting long-term loyalty.

* Fixxable is designed to meet UK data-protection and financial-communication standards — following Financial Conduct Authority (FCA) guidance on financial promotions for fair, transparent client messaging.

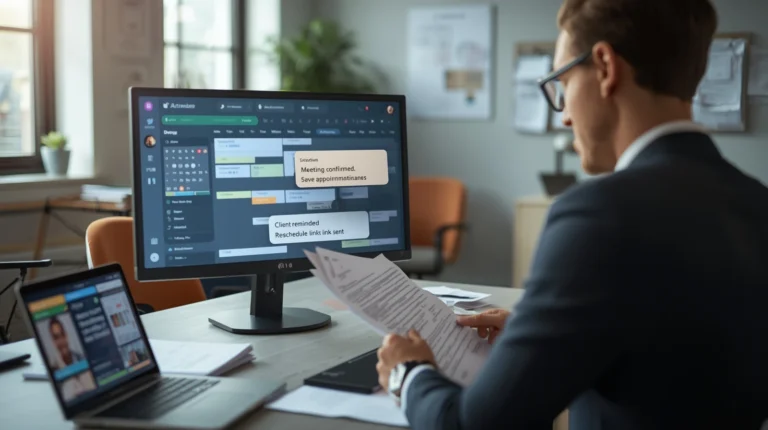

See How Automation Transforms Your Financial Workflow

With Fixxable automation, insurance and loan professionals manage clients, renewals, and repayments effortlessly through our all-in-one insurance and loan business automation system — saving time and building trust.

How Fixxable Transforms Your Insurance & Loan Business

Fixxable brings together client communication, renewals, applications, and payments — all in one simple insurance and loan business automation system. It’s designed for UK insurance brokers, financial advisers, and loan consultants who want to save time, stay compliant, and give clients a smoother experience through automation for financial services.

Never Miss a Client Enquiry Again

Fixxable automatically captures every insurance and loan enquiry from your website or marketing campaigns, then assigns it to the right adviser instantly. Every lead is logged, acknowledged, and ready for follow-up — without manual effort.

With Fixxable you can:

- Collect new client enquiries automatically from web forms and ads.

- Send instant confirmations via SMS or email.

- Auto-assign leads to advisers for quick responses.

- Keep client data secure and GDPR-compliant.

Schedule Meetings the Smart Way

Forget messy calendars and missed calls. Fixxable’s automated appointment system keeps your advisers and clients perfectly in sync.

You’ll be able to:

- Sync diaries with Google or Outlook in real time.

- Let clients book or reschedule meetings online.

- Send automatic reminders via email, SMS, or WhatsApp.

- Cut no-shows and save hours every week.

Automate Follow-Ups, Renewals & Reminders

Policy renewals and loan updates are easy to forget — but not with Fixxable. It automatically sends renewal notices, payment reminders, and client follow-ups, keeping your pipeline active and your retention rates high.

Fixxable helps you:

- Trigger renewal alerts before policies expire.

- Follow up on late payments automatically.

- Send personalised reminders without manual work.

- Maintain consistent, professional communication.

Keep Documents, Payments & Compliance in Order

Fixxable takes care of the admin that slows you down. From digital invoices to secure file storage, every client record is tracked and compliant with UK financial regulations.

What’s included:

- Create and send invoices automatically.

- Accept secure online payments with instant confirmation.

- Store signed contracts and policy documents safely.

- Keep full communication and audit trails for compliance.

Too Many Clients, Too Little Time?

Fixxable’s insurance and loan business automation helps UK brokers and advisers manage clients, reminders, and renewals — saving time and improving service quality.

Everything Your Insurance & Loan Business Needs — All in One Platform

Fixxable keeps your financial operations running smoothly with insurance and loan automation — from enquiries and appointments to renewals, payments, and compliance — all managed in one secure, connected system.

Manage New Enquiries Automatically

- Capture every insurance or loan enquiry from your website or ad campaigns.

- Assign each lead to the right adviser automatically — no manual sorting.

- Send instant follow-ups to improve response time and conversions.

Automate Appointments & Renewals

- Schedule, confirm, or reschedule client meetings in seconds.

- Get automatic reminders for loan updates or policy renewals.

- Cut no-shows and missed deadlines with built-in notifications.

Centralise All Client Communication

- Manage WhatsApp, email, and text messages from one secure inbox.

- Use pre-set templates for consistent, professional responses.

- Keep every client message recorded for compliance and audit trails.

Simplify Payments & Document Handling

- Generate branded invoices and secure payment links automatically.

- Store policy agreements, loan forms, and ID documents safely online.

- Eliminate paperwork and reduce human error with automated workflows.

Gain Real-Time Financial Insights

- Monitor payments, renewals, and response rates instantly.

- Identify top-performing products or advisers with clear reports.

- Export data for audits, team meetings, or performance reviews.

Frequently Asked Questions

Quick answers to common questions from UK insurance and loan professionals using Fixxable insurance and loan automation to simplify daily operations.

How does Fixxable help insurance and loan businesses?

Fixxable automates client enquiries, renewals, and loan follow-ups — reducing admin work and helping finance teams respond faster.

Can Fixxable handle multiple advisers or branches?

Yes — manage multiple advisers, branches, or departments easily from one connected dashboard.

Is Fixxable suitable for independent brokers?

Absolutely. Fixxable is designed for both independent brokers and larger finance firms that want to automate without hiring extra staff.

Does Fixxable integrate with accounting or CRM tools?

It connects seamlessly with tools like Xero, QuickBooks, and existing CRMs — syncing payments and client data automatically.

Is client data secure and GDPR-compliant?

Yes — Fixxable uses secure UK data hosting, encryption, and role-based access to protect sensitive financial information.

Fixxable ensures secure client data handling in line with UK Information Commissioner’s Office (ICO) data-protection standards.

Ready to Simplify Your Financial Operations?

Fixxable helps insurance brokers and loan advisers across the UK automate client management, reminders, and renewals — saving time and improving service quality.